A small business concern that was at least 51 percent owned by one or more individuals who were:- Women

- Veterans

- Socially and economically disadvantaged.

Applicants were required to self-certify on the application that they met eligibility requirements.

Socially disadvantaged individuals were defined as those who had been subjected to racial or ethnic prejudice or cultural bias because of their identity as members of a group without regard to their individual qualities.

Economically disadvantaged individuals were defined as those socially disadvantaged individuals whose ability to compete in the free enterprise system had been impaired due to diminished capital and credit opportunities as compared to others in the same business who were not socially disadvantaged.

Payment Calculations

The SBA provided several methods for calculating the award amount. For applicants in operation before or on January 1, 2019, the calculation involved 2019 gross receipts minus 2020 gross receipts minus PPP loan amounts.

Allowable Use of Funds

Per the SBA, RRF funds might be used for specific expenses, including:

Business payroll cost

Payments on any business mortgage obligation

Business rent payments

Business debt service, both principal and interest

Business utility payments

Business maintenance expenses

Construction of outdoor seating

Business supplies

Business Food and beverage expenses

Covered supplier costs

Business operating expenses.

All RRF recipients had to use award funds until March 11, 2023. Not later than December 31, 2021, all recipients were required to report how much of their award had been used against each eligible use category.

Restaurant Revitalization Fund Fraud Investigations

The Small Business Administration is aware that the Restaurant Revitalization Fund (RRF) Program risks some individuals submitting fraudulent applications to defraud the Government. For instance, if an applicant purposely inflated his 2019 gross revenue in order to allow for a greater fund request, he may be subject to prosecution for SBA or RRF fraud. Additionally, if the applicant used the Funds received for a non-approved purpose that had nothing to do with keeping their restaurant open, they may be subject to prosecution. For example, if an RRF award recipient used the funds to purchase luxury items or to finance expensive travel, they may be subject to prosecution.

While this is a new law, the Government has already begun investigations against individuals alleging they submitted fraudulent RRF loan applications or misused the funds received. As the money allocated was for relief, the Government is zealously investigating potential fraud cases. RRF fraud investigations could result in serious federal charges, including but not limited to the following:

-Conspiracy to Commit RRF Fraud

-RRF Fraud

-Wire Fraud and

-Money Laundering

Defending Against Restaurant Revitalization Fraud Allegations

There are potential defenses to RRF Fraud charges. The RRF loan application process is complicated, and an honest individual may make mistakes without criminal intent when completing the paperwork. Additionally, there may be no crime if funds were used in a unique but lawful manner to keep the restaurant open. Each allegation of RRF fraud will have to be examined to determine the best possible defense.

Every case is different, and defenses are based on the facts in each scenario. If you are under investigation for SBA or RRF fraud, you should take the matter very seriously and have legal representation. I have experience defending against this kind of investigation.

A SUMMARY OF CRIMINAL DEFENSE ATTORNEY ROBERT FICKMAN’S CREDENTIALS

- Robert Fickman has been a criminal defense attorney in Houston for 40+ Years.

- Robert Fickman has handled over 300 Federal Cases.

- Robert Fickman has kept some clients from being charged in Federal Court.

- Robert Fickman has obtained the dismissal of some Federal Charges.

- Robert Fickman has gone to trial in Federal Court and obtained acquittals on all charges for some clients. In 2022, Robert Fickman went to trial in United States v. Rebolledo. Robert Fickman’s client was the ONLY client in the entire case to be acquitted on all charges.

- Robert Fickman has argued many cases before the Fifth Circuit Court of Appeals.

- Robert Fickman has had an AV Rating (the highest rating) with Martindale Hubbell for over 20 years.

- Robert Fickman has been named a “Texas Super Lawyer” since 2015.

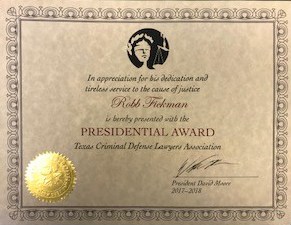

- Robert Fickman is well-respected by his peers, and he has received numerous awards.

- Robert Fickman was the President of the Harris County Criminal Lawyers Association (HCCLA) from 2006-2007.

- Robert Fickman is a past Board Member of the Texas Criminal Defense Lawyers Association (TCDLA).

- Robert Fickman serves on the HCCLA and TCDLA Strike Forces, where he is called upon to come to the aid of other criminal defense lawyers.